While on our honeymoon in Tasmania last year, my partner and I made the decision to do a working holiday in New Zealand sometime next year.

Making this decision entailed quite a number of implications that we’ve had to work out.

For one, we will be putting our careers on a stop for a year – this meant an opportunity cost of losing a year’s worth of income, and potentially impeding our career progression. It also means forking out hard cash to sustain our lifestyle for a year, amongst other considerations.

That said, it was something that my partner and I felt strongly about, and these were sacrifices that we were willing to make.

Source: Unsplash

A couple of months back, our close friend Wilfred mentioned that this is something many of his friends are interested in, but many are intimidated by the potential costs that will incur when going on a working holiday.

He also mentioned that it would be useful if I did a cost breakdown while I plan for the trip, so that others may be aware of how much to budget should they decide to take the leap.

If you’re someone interested in doing a Working Holiday in New Zealand – here’s an overview of what to expect. I hope it’s useful for you.

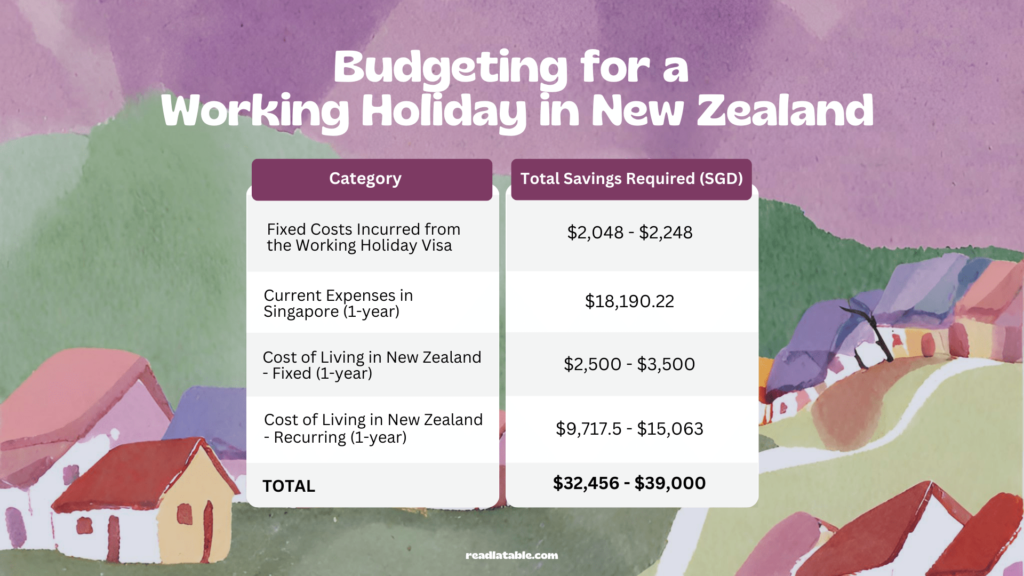

TL;DR: How Much I Need To Go on a Working Holiday in New Zealand as an Average Working Singaporean

| Category | Total Savings Required (1 pax) in SGD | Total Savings Required (2 pax) in SGD |

|---|---|---|

| Fixed Costs Incurred from the Working Holiday Visa | $2,048 - $2,248 | $4096 - $4,496 |

| Current Expenses in Singapore (1-year projection) | $18,190.22 | $24,148 - $33,148 |

| Cost of Living in New Zealand - Fixed Costs (1-year projection) | $2,500 - $3,500 | $5,000 - $7,000 |

| Cost of Living in New Zealand - Recurring Costs (1-year projection) | $9,717.5 - $15,063 | $19,435 - $30,125 |

| TOTAL | $32,456 - $39,000 | $52,679 - $74,769 |

| TOTAL (NZ Expenses only) | $14,266 - $20,810 | $28,531 - $41,621 |

On the safe side, my partner and I are intending to budget about $33,000 for the trip.

This is a number that we are still working towards this year. I will be sharing more on how we intend to budget and save for this trip in subsequent articles.

For this article, I’ve broken down the costs into different categories. Mainly:

- Fixed expenses incurred for the working holiday

- Current commitments or things that I’ve to pay for in Singapore

- Fixed costs from living in New Zealand for a year

- Recurring costs from living in New Zealand for a year

Why Go On A Working Holiday? What about Your Job? Aren’t You Sabotaging Your Career Progression?

This was probably the most commonly asked question posed to us by our friends and family. My mother, in particular, was rather unhappy with my decision to do this.

Being someone who is rather competitive, taking a year-long break was also an uncharacteristic thing for me to do.

So why did I do it?

1. Wanting to experience an alternative lifestyle before deciding whether or not to settle down in Singapore

Source: Unsplash

I have always wanted to live close to nature, and to try out a lifestyle that’s away from the constant hustle and bustle of city life.

Having been through the Singapore system over the past 27 years, I didn’t want to get married, get a BTO, and settle down in Singapore without having the chance to experience how my life would be if I were to stay in another country for an extended period of time.

So often are we caught up with our day-to-day life that we forget that there is an alternative if we choose to seek it. Going for a working holiday takes me out of my everyday routine, and allows me the time and space to think about what I really want to do with my life free from societal expectations.

2. Experiencing life when I am still healthy and able to do so

Source: Unsplash

A couple of my friends are hustling hard in their youth, and are subscribing to the FIRE (Financial Independence, Retire Early) mentality, where they strive to maximise their earnings and investments in their youth so that they can enjoy later by retiring early.

While I believed in that a couple of years ago, I now subscribe to a different mentality. My goal in life isn’t to be rich but to have enough to lead a simple, contented life.

This means that I would rather travel on a budget and go for long hikes while I’m still healthy, rather than go on luxurious holidays in my 40s. The reality is, that it is easier to rough it out, travel on a budget, and go for long hikes while you’re still young. Given my traveling style, this makes me happier than most material comforts money can afford.

3. The money spent on travel is worth it to me

I am a huge believer in spending on experiences, so much so that I would try my best to save on other expenses – such as having a simple wedding, and thrifting all types of furniture in my new home.

While the estimated cost for a working holiday is $30,000-$35,000, I believe that the actual cost may be less if we take the chance to work odd jobs in New Zealand during the year.

4. Doing this was worth the opportunity cost, and sacrificing my career progression

Source: Unsplash

A few months ago, I went for a job interview at a huge multinational corporation. At the end of the interview, I asked the manager if there were any reservations about hiring me.

Her answer was a valid one – She mentioned that while I had extensive work experience and seemed like I could do the job, she didn’t like that I was at my previous job for only 2 years.

I was a little bummed out for not getting the offer. That said, the reality is sometimes like this. Going on a career break, staying in a company for too short a time, and taking a year-long sabbatical are valid reasons that may cause hiring managers to reject your application.

However, after some reflection, I came to two realisations: For one, I will be working for the next 40 years of my life. One year is not going to impede my career progression in the grand scheme of things.

Second, a job that focuses on how long you’ve been with a company, instead of the impact and results you’ve delivered as an employee is not one that aligns with my working style – there will be other opportunities in the future. Life is also too short to place so much emphasis on your full-time job.

How to Budget For Your Working Holiday

1. Fixed Costs Incurred from the Working Holiday Visa

Source: Unsplash

One of the first few things that I’ve considered for the trip was the upfront costs required for the trip.

| Item | Cost per person | Cost for 2 people |

|---|---|---|

| Working Holiday Visa Application Fee | $370 (NZD 455) | $740 for 2 people |

| Chest X-Ray Scan | ~$78 | $156 for 2 people |

| Flight ticket (Budgeted for both ways) | ~$1,600 - $1,800 / pax | $3,200 - $3,600 for 2 |

| Total Fixed Costs | $2,048 - $2,248 per person | $4,096 - $4,496 |

*All costs are calculated in SGD

I have already applied for a working holiday visa and have a good overview of the cost for that. For flight tickets, I put in an estimated budget for an Economy Flight from a domestic airline.

2. Current Recurring Expenses That We Are Still Required to Pay in Singapore

Source: Unsplash

We’ve recently bought a resale flat and are required to pay a recurring monthly mortgage loan.

Should we decide to go overseas for a year, there are still financial commitments back in Singapore that we have to pay for.

Beyond the mortgage loan, there is also a hidden cost that comes with maintaining a home. These are also accounted for in our expenses:

| Item | Cost / Month per person | Projected Costs (1 year, 1 person) | Projected Cost (1 year, 2 person) |

|---|---|---|---|

| Mortgage Loan | $913 / month ($835 + $78 in taxes) | $10,956 | $21,912 |

| Utilities | ~$100/month (will be estimated as 0) | 0 | 0 |

| SNCC Charges | $78 | $936 | $936 |

| Property Tax | $13.33 | $160 | $160 |

| Home Internet | $35 | $420 | $420 |

| Phone Bill | $30 | $360 | $720 |

| Personal Insurance | $446.50 | $5358.22 | $9,000 |

| Total Recurring Expenses in Singapore | $1,515.83 / month | $18,190.22 | $33,148 |

*All costs are in SGD and are an estimated cost.

3. Cost of Living in New Zealand

Source: Unsplash

3.1 Fixed Costs

Starting with fixed expenses, we plan to purchase a car during our time in New Zealand and hopefully sell it off on Facebook Marketplace when it’s time to leave the country.

Getting a second-hand car in New Zealand is a lot cheaper as compared to Singapore, as such, we budgeted about $4,000-$6,000 for it.

For our outdoor adventures, I’m budgeting around $500 for winter clothing and hiking gear.

| Item | Budget (for 1 pax) | Budget (for 2 pax) |

|---|---|---|

| Car / Campervan | $2,000-$3,000 (this is a shared expense that I just divided by 2) | $4,000-$6,000 |

| Winter Clothes, Hiking Gear and other necessities | $500 / pax | $1,000 |

| Total | $2,500 - $3,500 | $5,000 - $7,000 |

3.2 Monthly Recurring Costs

Source: Unsplash

On a monthly basis, we plan to rent a single room in a shared home. The estimated cost of a room rental in New Zealand is about 250-375 NZD a week, which adds up to about 1,500 NZD per month.

Groceries are expected to be a little more expensive in New Zealand as compared to Singapore, so budgeting 400-550 NZD per month is admittedly a bit low.

As we plan to take on odd jobs during our stay or try out WWOOFing (where you work in exchange for accommodation at a local’s home), the monthly recurring costs projected here will be slightly lower than average.

Here is the breakdown:

| Item | Shared Cost / Month (2 pax) | 1 Year Projected cost (NZD) | Remarks |

|---|---|---|---|

| Accommodation Costs | 1,000 - 1,500 NZD | 12,000 - 18,000 NZD | Assuming 250-375 NZD / week rental |

| Food and Groceries | 400 - 550 NZD | 4,800 - 6,600 NZD | 400-550 NZD / month grocery budget for 2 pax |

| Laundry and hygiene-related products | 60 - 100 NZD | 720 - 1,200 NZD | Budgeted 30-50 NZD / month per person for hygiene expenses |

| Local Phone Bills | 40 - 50 NZD | 480 - 600 NZD | Bill showed for 2 pax Phone bill estimated at 20-25 NZD/month per person) |

| Transportation (Petrol etc) | 200 - 400 NZD | 2,400 - 4,800 NZD | |

| Car Insurance Premium | To be confirmed | To be confirmed | Unsure of local car insurance premiums |

| Travel Insurance | To be confirmed | To be confirmed | Not yet calculated |

| Leisure (Eating out, attractions) | 300 - 500 NZD | 3,600 - 6,000 NZD | |

| Healthcare and Insurance | To be confirmed | To be confirmed | |

| Total | 2,000 - 3,100 NZD / month | 24,000 - 37,200 NZD / year | Total expenses calculated for 2 people |

| Total (SGD) | $1,620 - $2,511 / month | $19,435 - $30,125 / year | Calculations in SGD for 2 pax |

4. Our Estimated Total Cost

Source: Unsplash

| Category | Total Savings Required (1 pax) in SGD | Total Savings Required (2 pax) in SGD |

|---|---|---|

| Fixed Costs Incurred from the Working Holiday Visa | $2,048 - $2,248 | $4096 - $4,496 |

| Current Expenses in Singapore (1-year projection) | $18,190.22 | $24,148 - $33,148 |

| Cost of Living in New Zealand - Fixed Costs (1-year projection) | $2,500 - $3,500 | $5,000 - $7,000 |

| Cost of Living in New Zealand - Recurring Costs (1-year projection) | $9,717.5 - $15,063 | $19,435 - $30,125 |

| TOTAL | $32,456 - $39,000 | $52,679 - $74,769 |

| TOTAL (NZ Expenses only) | $14,266 - $20,810 | $28,531 - $41,621 |

How We Saved ~$30,000 For A Working Holiday to New New Zealand

Source: Unsplash

With the budget in mind, here’s how we worked towards saving this amount over the course of the year.

1. Stretching out our mortgage loan

Rather than putting a shorter tenure for our mortgage loan for our resale flat, we decided to push our repayment period to 20 years, lowering the monthly repayment for our mortgage loan.

Granted, this will incur more interest over time, but this allows us some cash flow during our year abroad, without putting us in too much financial stress. We were on an HDB loan at a prevailing interest rate of 2.6% for a few months, before we refinance to a DBS loan at a 5-year fixed rate of 1.9% interest per year.

2. Saving 50% of our income for a year

Source: Unsplash

For a good part of last year, I tried saving 50% of my income for the year for the working holiday. Here’s a projection of my savings over the course of the year:

| Category | Amount ($) | Remarks |

|---|---|---|

| Savings on January 2023 | $6,000 | My savings at the end of January 2023 |

| Monthly Savings Amount | $1,700 | 50% of $3,400 take home salary = $1,700 |

| Savings from Salary After 12 Months | $20,400 | $1,700 x 12 = $20,400 |

| Total Savings By December 2023 | $26,400 | $20,400 + $6,000 = $26,400 |

| Total Savings by March 2024 | $31,500 | I left my full-time job in March 2024, so I stopped saving 50% of my income then. |

3. Taking on side hustles to increase our income

Source: Unsplash

It was difficult to survive on just $1,700 per month last year, given that I had fixed expenses such as mortgage loans, utility bills, and food expenses.

To ensure that I can save 50% of my income sustainably for a year, my partner and I take on tuition as a side hustle. I taught math to 4 secondary school students over the weekend, and earned an additional $600 – $800/ month to supplement the income.

4. Earning enough to cover my expenses as a self-employed person this year

Source: Unsplash

When I left my job in March this year, I had to make sure that I did not eat into my working holiday budget by having multiple freelance gigs to cover my expenses. Here’s how I earned ~$2,000/month as a self-employed person 6 months after quitting my job.

Budgeting for a Working Holiday in New Zealand

Preparing a comprehensive budget is an indispensable step for anyone embarking on a Working Holiday adventure in New Zealand.

While planning for your own trip, do keep in mind that my personal expenses and assumptions are unique to my circumstances.

As such, if you are planning to do a working holiday, it is important to calculate your own finances, considering factors such as your own habits and preferences, as well as existing financial commitments.

If you would like to stay updated on my planning process for the working holiday or keep up to date with fresh value-adding content, feel free to join our Telegram community!

1 thought on “How to Budget For A One-Year Working Holiday in New Zealand”

Pingback: Preparing for Your Working Holiday To New Zealand: A Comprehensive Guide - readlatable

Comments are closed.