In Singapore, retrenchment refers to the termination of permanent employees due to redundancy. While the number of retrenchments decreased in 2021 and 2022, there has been an uptick in retrenchments in Q1 2023, with 4,000 workers losing their jobs.

Experiencing retrenchment can be challenging and stressful, as it disrupts your livelihood and financial stability.

However, as an employee, you have certain legal rights and entitlements that can help alleviate the financial burden during this period. It is crucial to understand these rights and take appropriate steps to navigate through this difficult situation.

Signs That You Might Be at Risk of Retrenchment

Retrenchment often comes as a surprise to employees, but there are certain signs that may indicate you are at risk. Recognising these signs can help you prepare yourself and take proactive measures.

Here are six potential signs that you might be getting retrenched:

1. Quiet Firing: Undermining Employee Contributions

Source: Vice Media

The term “quiet firing” has been trending on social media platforms like TikTok for a while. Quiet firing refers to how employers, instead of overtly laying off employees, resort to passive-aggressive tactics to undermine an employee’s contributions and convince them to leave voluntarily.

This can involve neglecting their work or reducing important, value-adding or decision-level work, leading to a decline in morale and motivation.

If you notice a consistent pattern of your contributions being undermined or undervalued, it could be a sign that your employer is trying to push you out of the company.

2. Huge Changes in Company Structure, or Talks about an Acquisition or Merger

Source: Unsplash

A company undergoing a major restructuring may lead to retrenchment.

Restructuring is often accompanied by cost-cutting measures, and employees are considered one of the costliest resources. If you realise that your company is going through a restructuring process, this might be a sign that there will be a round of firing.

3. Constant Mention of Profitability Issues

If your company frequently emphasises profitability issues, it could be a warning sign. Constant mentions of profitability problems indicate that the company is facing financial challenges and may need to cut costs to improve its financial situation. This can manifest as pay cuts or retrenchments.

4. Freeze on Spending and Budget Reductions

Source: Unsplash

When a company implements a freeze on spending, it often includes measures such as withholding new staff hires, reducing training courses, and cutting back on marketing and advertising campaigns. Even seemingly small cost-cutting measures like reducing staff lunches or meal treats can be indicative of retrenchment efforts.

5. Unscheduled Budget Review or Reductions

Unscheduled budget reviews can be a cause for concern. If a company conducts an unscheduled budget review, it may suggest that the company is experiencing significant losses or not meeting its profit targets. In such cases, retrenchment may be considered as a cost-saving measure.

6. Industry Competitors Going Out of Business

Source: Unsplash

While the closure of competitors’ businesses may initially seem like an opportunity for your company to gain market share, it can also indicate broader struggles within the industry. If multiple companies in your industry are going out of business, it may be a sign that the entire sector is facing challenges. This can have implications for your own company and potentially lead to retrenchments.

7. Mass Departures of High-Level Executives and Peers

If you notice a significant number of high-level executives and peers leaving the company around the same time, it could be a sign of impending retrenchment. Mass departures at the leadership level are often an indication of organizational changes and can precede retrenchments across various departments.

Legal Rights and Retrenchment Benefits for Employees in Singapore

Source: Unsplash

As an employee facing retrenchment in Singapore, you have certain legal rights and entitlements that can help mitigate the financial impact of losing your job. It is important to be aware of these rights and understand the benefits you are entitled to. Here are some key points to consider:

1. Notice Period and Support for Transition

Under the Employment Act, employers are required to provide employees with a notice period based on their length of service. The minimum notice period ranges from 1 day for employees with less than 26 weeks of service to 4 weeks for employees with 5 years or more of service.

A longer notice period allows employees to prepare for the transition and seek alternative employment.

In addition to the notice period, employers are encouraged to provide support to retrenched employees during their transition period. This can include career counselling, job placement services, or training opportunities to enhance employability.

2. How Much Am I Entitled To If I’m Retrenched In Singapore?

Retrenchment benefits, also known as severance pay, are not mandated by law in Singapore. However, they are highly encouraged by the Ministry of Manpower (MOM).

In general, the stipulated compensation ranges from two weeks to one month of the employee’s salary per year of service. For unionised companies, the compensation is typically one month’s salary per each year of service.

It is important to note that retrenchment benefits are subject to negotiation and may vary depending on individual circumstances and agreements. If a company fails to pay the deserved retrenchment benefits, employees can file a claim with the Tripartite Alliance for Dispute Management (TADM) for resolution.

3. I am an Older Employee (Age 63 and Above) That Got Retrenched. What Compensations Am I Entitled To?

Source: Unsplash

Employees who are retrenched at the retirement age of 63 are entitled to re-employment until the age of 68. This means that employers are obligated to offer suitable job positions to these employees until they reach the age of 68.

If a suitable job cannot be found, employers are required to offer an Employment Assistance Payment (EAP) as per the Tripartite Guidelines for Re-employment of Older Workers.

The EAP is a one-time payment equivalent to 3.5 months’ salary, with a minimum of S$6,250 and a maximum of S$14,750.

4. What if I Get Retrenched When I’m Pregnant?

Employees who are pregnant during the retrenchment are entitled to maternity leave benefits if they qualify under the Employment Act or Child Development Co-Savings Act.

Maternity leave benefits are provided in addition to retrenchment benefits. The maximum maternity benefit is up to 16 weeks of paid maternity leave, with the usual monthly salary accrued during the leave period.

Source: Unsplash

Retrenched employees are also entitled to restructured medical benefits. Employers should provide additional MediSave contributions or other flexible benefits to help employees manage ongoing healthcare cost.

It is important to consult the Ministry of Manpower (MOM) website or seek legal advice for specific details regarding your rights and entitlements as an employee facing retrenchment in Singapore.

Practical Steps to Take After Being Retrenched

Source: Unsplash

Experiencing retrenchment can be emotionally and financially challenging. However, there are practical steps you can take to navigate through this difficult period and regain financial stability. Here are some essential steps to consider:

1. Build an Emergency Budget

Source: Unsplash

Building an emergency budget is crucial to prepare for unexpected events like retrenchment.

Depending on the individual, an emergency fund consisting of three to six months of your salary or monthly expenditure can provide a financial safety net during unemployment.

Allocate a portion of your salary each month to a dedicated account, such as a high-yield savings account or a cash management account, to build your emergency fund. These funds should be easily accessible and highly liquid.

2. Explore Government Support and Career Guidance Services

Source: Unsplash

There are numerous untapped resources for unemployed Singaporeans. Here are some that you can explore to help you through this transition.

Skillsfuture Resources

You may make use of the following tools via the Skillsfuture website:

- Take Online Assessments to determine which career paths are suitable for you

- Explore the Skills Framework in your industry:

- I found this tool very helpful – The site provides a checklist to see if you have the right hard skills required for your industry, and shows you relevant courses that you can take to bridge the gap.

- Browse Upskilling Courses and Certifications that you can take

- Get funding for courses that you’re interested in

- Book 1-1 Consultation with a Career Guidance Counsellor

Majulah Package: Earn and Save, Retirement Savings and MediSave Bonuses

| Earn and Save Bonus | Retirement Savings Bonus | MediSave Bonus | |

|---|---|---|---|

| Funding | CPF bonus of up to $1,000 yearly for lower or middle income workers, as long as they work full-time or part-time | One-time bonus of up to $1,500, whether you’re working or not | One-time payout of $1,000 |

| Eligibility | Singaporeans born 1973 or earlier Pioneer, Merdeka Generation seniors | Singaporeans born 1973 or earlier Pioneer, Merdeka Generation seniors | Singaporeans born 1973 or earlier Pioneer, Merdeka Generation seniors |

| How to Apply | Automatically enrolled if eligible | Automatically enrolled if eligible | Automatically enrolled if eligible |

If you are an older employee, or a lower-income worker facing retrenchment, you may explore schemes such as the Workfare Income Supplement and Silver Support Scheme to supplement your income.

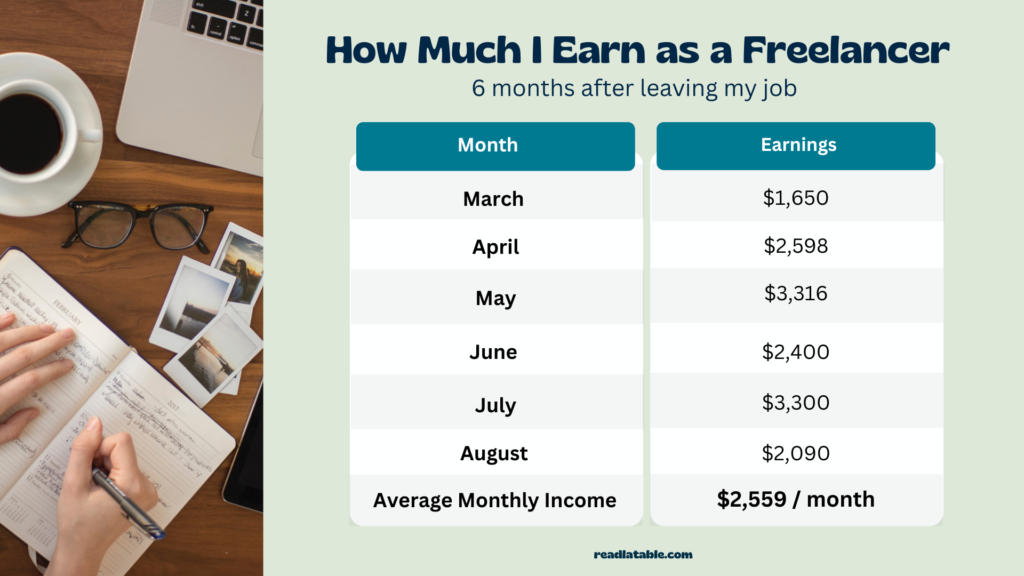

3. Create Multiple Streams of Income

Diversifying your sources of income through multiple streams can provide stability and resilience during periods of unemployment.

Consider exploring side hustles or part-time opportunities that align with your skills and interests. You may also consider taking up different part-time jobs, or monetising your hobbies to tide you through.

Read More: How Much I Earn As A Self-Employed Person 6 Months After Quitting My Job

4. Prioritise Debt Repayment

If you have outstanding debt, prioritise repaying it to avoid additional financial stress. Analyse your debt obligations and target high-interest loans first

If you are struggling to repay multiple credit card debts, consider a debt consolidation plan or a balance transfer to streamline your debt and potentially reduce interest rates.

5. Review Your Insurance Coverage

Evaluate your insurance coverage, including health insurance, life insurance, and critical illness insurance. If you have insurance policies, review the terms and conditions, including any retrenchment benefits or premium payment options during unemployment.

Some policies may offer a premium holiday or allow partial withdrawals from accumulated cash value. Contact your insurance provider to discuss the available options and make informed decisions based on your needs.

6. Update Your Resume and Enhance Your Skills

Take advantage of the time during unemployment to update your resume and enhance your skills. Tailor your resume to highlight your achievements and skills that are relevant to your desired industry or job roles.

Consider attending workshops, online courses, or acquiring certifications to enhance your knowledge and skills. These efforts can improve your employability and increase your chances of finding a suitable job.

7. Network and Seek Job Opportunities

Networking is crucial in the job search process. Reach out to your professional network, attend industry events, and participate in online communities to expand your connections.

Inform your network about your job search and ask for referrals or recommendations. Utilise online job portals, career websites, and recruitment agencies to explore job opportunities.

8. Take Care of Your Emotional Well-being

Source: Unsplash

Facing retrenchment can take a toll on your emotional well-being. It is important to prioritise self-care and seek support from friends, family, or professional counselors.

Maintain a healthy routine, engage in activities that bring you joy, and stay positive during your job search journey. Remember that retrenchment is a temporary setback, and with resilience and perseverance, you can overcome it.

If you’re looking for free and affordable mental health services to keep your well-being in check, you may refer to the article below.

Read More: Affordable Therapy in Singapore with Individual Sessions from $30/Session

Getting Retrenched in Singapore

Experiencing retrenchment can be a challenging and uncertain time. However, understanding your legal rights, and entitlements, and taking proactive steps can help you navigate through this period with greater financial stability.

Remember that being retrenched is not a reflection of your capabilities, as it may be due to many other factors that lie outside of your individual performance.

Take a break, give yourself time to learn and improve, and with the right support, it may be a start to something new or exciting for you.