Last week, I switched my mum over from Eldershield to Careshield Life. I was honestly quite confused over the implications of doing so since she was diabetic and she already had an Eldershield Comprehensive rider by Great Eastern.

There wasn’t a lot of content regarding this online, so I thought I would write a quick article to plug in the gap.

To be sure, I’m not a personal finance site, nor am I a financial advisor, so what’s written is based on my research on what I did for my mum.

What is Eldershield and Careshield Life? Which scheme is my parents under?

In a nutshell, Eldershield and Careshield Life are financial assistance schemes launched by the government to provide payouts to individuals when they’re met with severe disabilities.

Until 2019, all Singaporean citizens and PRs with MediSave accounts are automatically enrolled into ElderShield at 40, unless they opt out, are born on 30 September 1932 or before, or are severely disabled before enrolment.

Singaporeans born in 1980 or later will automatically be covered under CareShield Life from 1 October 2020, or when they turn 30, whichever is later.

All these sounds rather complicated, so if you want to know what scheme your parents are on, go to the Careshield Life website, log in with your parent’s Singpass and you should be able to see which policy your parents are enrolled in.

If your parents are about 60+ years old like mine, chances are, they’re probably enrolled under the ElderShield 400 scheme.

Why are people changing over from Eldershield to Careshield Life?

My mum has been bugging me to look into this for her for a few reasons. For one, she’s heard from her sisters that from now till 31 December 2023, the government is providing up to $4,000 of incentive for Eldershield participants to switch to Careshield.

This comes in the form of premium subsidies. So for example, when switching my mother over from Eldershield to Careshield Life, I would normally have to pay an annual premium of $950++.

When I enroll her in Careshield Life before December 2023, she will be paying a premium starting from $750/year instead of $950*.

*Note: Premium amount varies depending on each individual

Secondly, my uncle recently had a debilitating stroke, and after utilising his ElderShield Plan, he wasn’t able to switch to Careshield Life due to this pre-existing condition.

When met with a serious medical condition like a stroke, I would imagine the lifetime payouts from Careshield Life would be more helpful in defraying healthcare costs incurred from permanent disability.

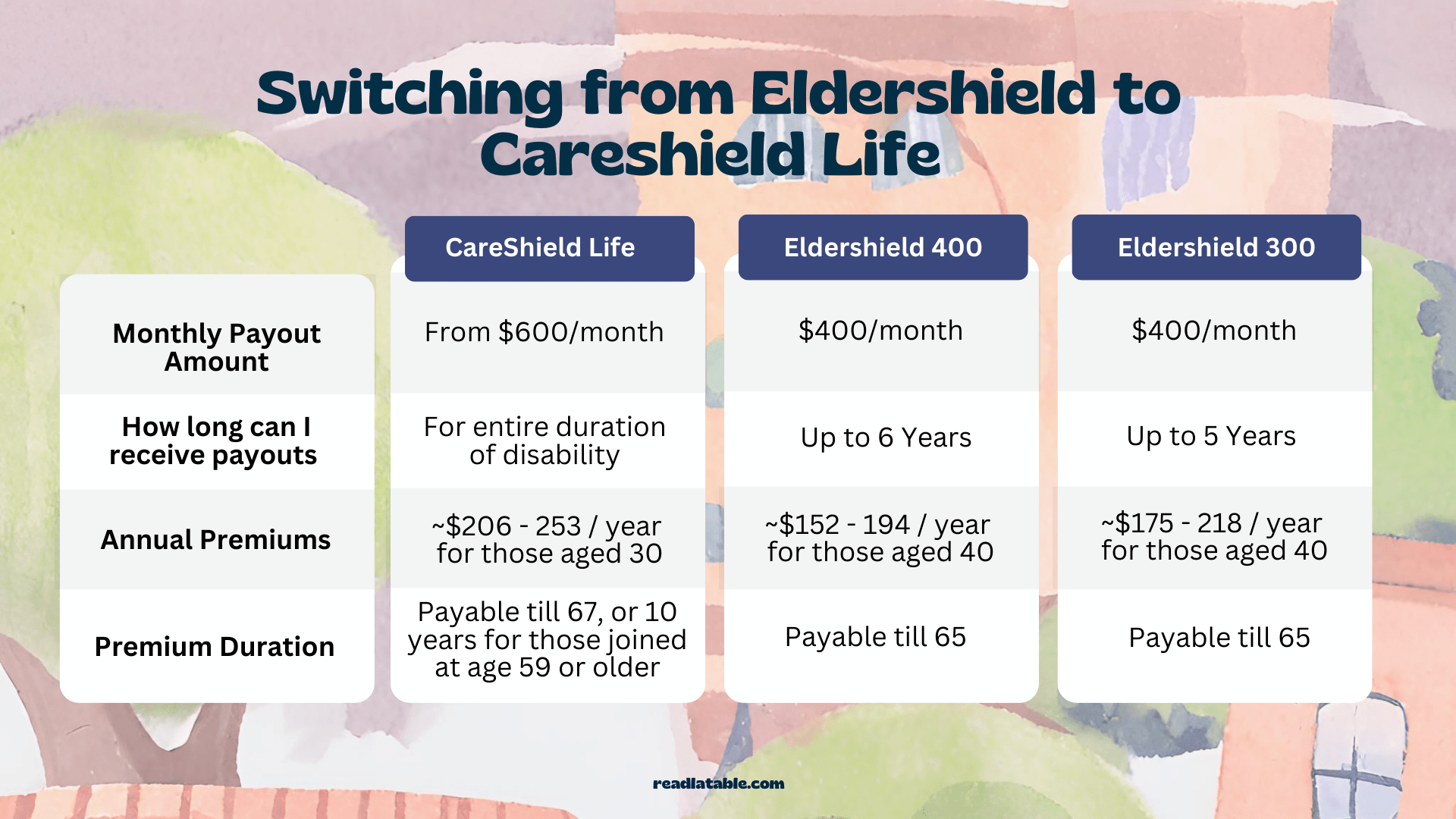

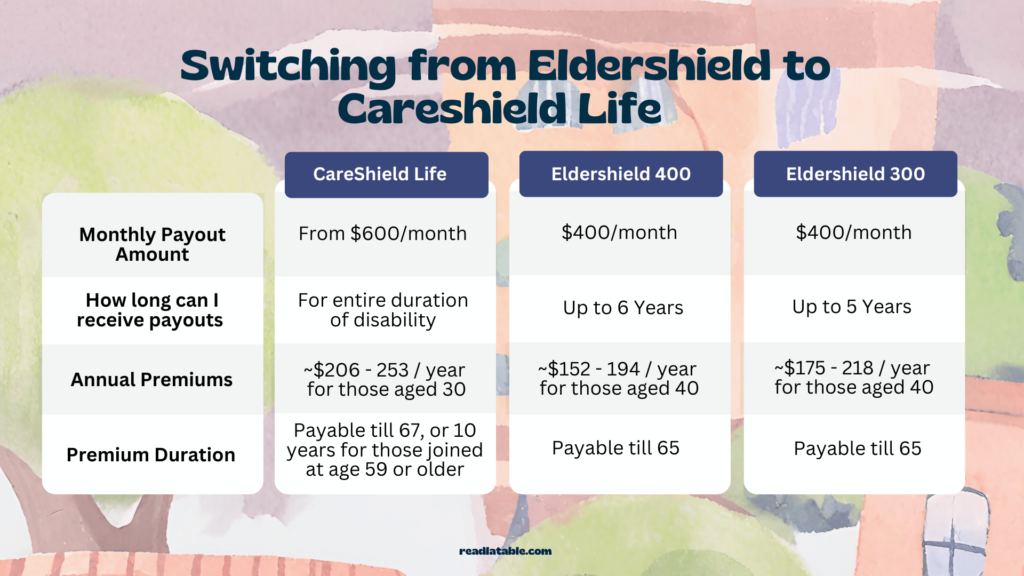

Lastly, there are obvious benefits to CareShield Life as compared to the Eldershield plans. You can compare their differences in the table below:

| CareShield Life | ElderShield 400 | ElderShield 300 | |

|---|---|---|---|

| Monthly Payout Amount | From $600/month (increases by ~2% yearly until 67) | $400/month (Fixed payout) | $300/month (Fixed payout) |

| How long can I receive payouts | For entire duration of disability | Up to 72 months (6 years) | Up to 60 months (5 years) |

| Payout conditions | Unable to perform 3/6 Activities of Daily Living independently from assessment | Unable to perform 3/6 Activities of Daily Living independently from assessment | Unable to perform 3/6 Activities of Daily Living independently from assessment |

| Annual Premiums | From $206 (men) and $253 (women) in 2020 at the entry age of 30 Premium increases by approx. 2% annually | Assuming entry age of 40, premiums start from $152 for men and $194 for women Premium is fixed | Assuming entry age of 40, premiums start from $175 for men and $218 for women Premium is fixed |

| Premium Duration | Payable till 67 years old, or for a period of 10 years for those who join at age 59 or older | Payable till 65 years old | Payable till 65 years old |

The biggest benefit of switching over from Eldershield to Careshield Life would be the higher payouts ($600 VS $400/month), and the fact that Careshield Life offers lifetime payouts (vs 6 years). That said, this is subjected to yearly assessment criteria, where your parents will only get the payouts each year if the G has successfully assessed your parents to be unable to perform 3/6 Activities of Daily Living.

Key Considerations I Had Before Switching from Eldershield to Careshield

1. Looking at your parents’ Pre-Existing Condition

My mother has diabetes. That’s terrible because when it comes to buying insurance or changing over to a new policy, I have to be very aware that a new policy bought does not cover pre-existing conditions.

For Careshield Life, she has to go through underwriting (basically, CPF will process her application and take note of her pre-existing condition while evaluating whether or not to approve her application).

If her application is successful and she’s enrolled into Careshield Life, she will be able to claim the payouts, even in the event where *touch wood* she gets a disability due to diabetes (pre-existing condition)

However, the pitfall here is that while she may enjoy Careshield Life benefits, she is unable to purchase a Careshield Supplement Rider (basically an insurance rider on top of Careshield Life that gives more $$$), due to her pre-existing condition.

2. Do my parents have existing Eldershield Riders?

I was hesitant to switch my mother over to Careshield Life because she had an existing insurance rider from Great Eastern called Eldershield Supplement.

With Eldershield Supplement, she has the added benefit of having an additional lifetime payout of $400/month on top of her $400/month from Eldershield in the event of a disability.

| Eldershield 400 | Eldershield Supplement GE | Total | |

|---|---|---|---|

| Condition | Unable to perform 3/6 ADLs | Unable to perform 2/6 ADLs | - |

| Benefit | $400/month | $400/month | $800/month for 6 years $400/month thereafter |

| Duration of Benefit | 6 years | Lifetime | - |

I was initially worried that upgrading to Careshield Life would result in it not being compatible with the Eldershield Supplement. I’ll address this in the next section below.

3. Is Eldershield Supplement Rider Compatible with Careshield Life?

After speaking to multiple insurance agents and a CPF representative to ascertain this, I found out that any insurance riders that are complementary to the old Eldershield plan will still be active if you switch from Eldershield to Careshield.

Insurance companies will have to honour the older Eldershield rider, given that their clients have been paying premiums for them over the years. That means that when I switch my mother over to Careshield Life, she will be enjoying the following benefits:

| Careshield Life | Eldershield Supplement GE | Total | |

|---|---|---|---|

| Condition | Unable to perform 3/6 ADLs | Unable to perform 2/6 ADLs | - |

| Benefit | $600/month | $400/month | $1,000/month |

| Duration of Benefit | Lifetime | Lifetime | - |

4. My Eldershield premiums are almost paid up. Is it worth paying additional premiums for Careshield Life?

Given the additional benefits, it makes sense to switch from Eldershield to Careshield Life. However, the biggest consideration would be whether or not switching would be worth the additional premiums you have to pay.

If your parents are in their 60s, chances would be that their Eldershield premiums would already be paid up, so switching to Careshield Life would entail paying premiums for another 10 years. Using my mother’s estimated premiums as an example, this is how much more you will be expected to pay.

| Premium payable per year | $750 / year, 2% increase in premiums every year till 67. |

| Projected premiums to be paid over 10 years | ~$7,500-$7,800 |

From the projection, my mother will be paying an additional $7,500+ in premiums over the next 10 years.

Do note that when you make the switch, you will only be paying premiums for CareShield Life. There’s no need to continue paying premiums for your Eldershield plan.

You may use your MediSave account to pay for your CareShield Life premiums.

So Why Did I Switch My Mum From Eldershield to Careshield Life?

At the end of the day, I decided to switch my mum over the Careshield Life for a couple of reasons: First, I am a more risk-averse individual, so having more lifetime coverage is something that gives me more security. With the rising cost of living, I believe a payout of $400-800/month may not be enough to cover healthcare needs in the event of a disability.

Second, an additional $7,500 worth of premiums spread across 10 years is something my mum can still afford, so it was a calculated risk that we could take.

Lastly, having her premiums start at $750/year with the added government incentives did make it a bit more attractive to make the switch, as she will be paying a discounted premium over the next few years. Given that it is also compatible with her current Eldershield Supplement, I thought it made sense to make the switch.

Hope this was helpful for you, and don’t hesitate to reach out if you have any questions or comments.

—

#PlanningforParents is a series where I talk about all things related to financial, healthcare, and life planning for your parents. As a millennial part of the sandwich generation (and parents that are not the most financially savvy), a lot of my mind space is taken up to ensure that my parents can retire comfortably and that their healthcare needs are taken care of as they age.

I hope to share these personal experiences with you, as well as provide some practical guides so that planning for your parents can be hassle-free.